China sees more pension funds entrusted for investment

BEIJING -- China's local governments have entrusted more of their basic pension funds for investment, as the country moves to tackle the challenge of an aging society.

By the end of March, 12 provincial-level regions including Beijing and Shanghai had signed contracts to entrust a total of 475 billion yuan (75 billion U.S. dollars) in pension funds to the National Council for Social Security Fund (NCSSF), according to the Ministry of Human Resources and Social Security.

Of the total, 306.65 billion yuan is in place and has started to be invested, the ministry said.

Pensions in China were traditionally held by banks or used to purchase treasury bills with annual yields far below the market average.

Given an aging population, China faces more pension payment pressure and has been exploring ways to preserve and increase the value of its around 4-trillion-yuan of pension funds. Measures have been rolled out to allow investment in more profitable financial products.

The NCSSF said it earned an annual average return of over 8 percent on its investments over the past decade.

The country had around 240 million people aged over 60 at the end of 2017, accounting for 17.3 percent of the total population.

- Arab League delegation visits China-Arab Research Center on Reform and Development for 10th anniversary

- Shanghai Jiao Tong University launches Center for Studies of Global South Sustainable Development

- Ex-CNNC general manager faces disciplinary probe

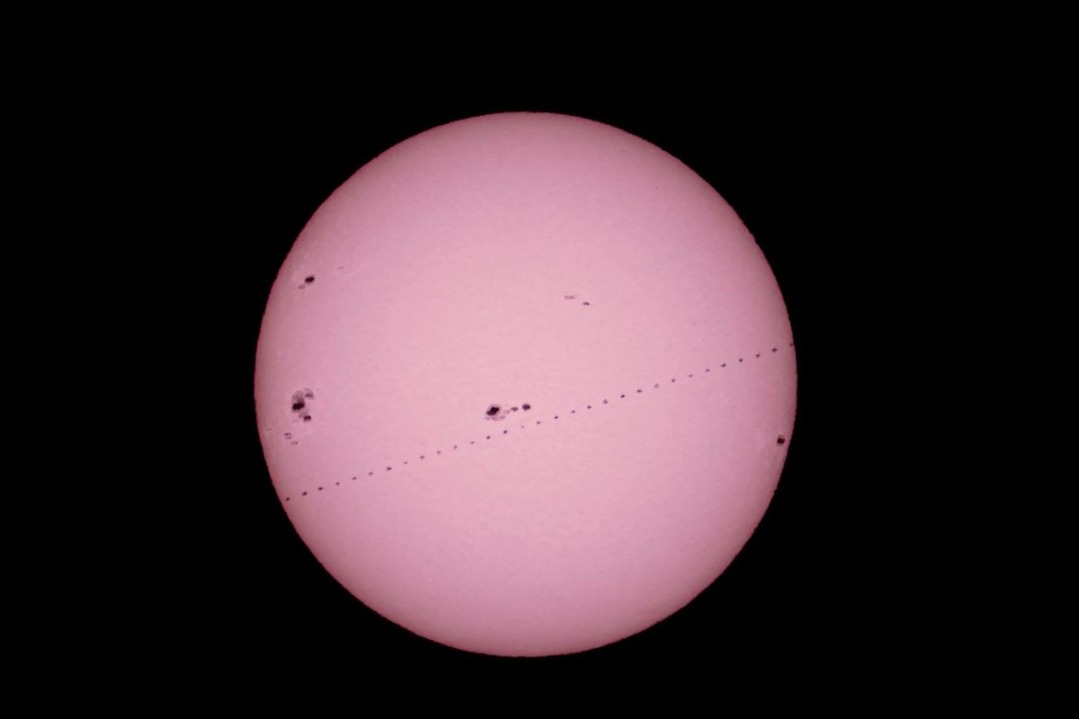

- China launches long march 12 rocket, deploys satellites for expanding space network

- Global gathering transforms Yixing village into youth hub

- China's prosecutors intensify crackdown on crime, charge 1.27 million in first 11 months of 2025